By 2025, diminished value claims in auto insurance evolved to include not just physical damage but also market, technological, and societal factors affecting vehicle resale value. Digital innovation has transformed claim handling with precise assessments, faster processing, and improved transparency. These claims ensure fair repairs, encourage accountability, and drive innovation in restoration practices, increasing customer satisfaction and peace of mind.

In 2025, diminished value claims remain a vital consideration in auto insurance. This article explores why these claims still matter and how they have evolved over time. From understanding the current landscape of diminished value claims to analyzing the impact of evolving auto insurance trends, we delve into their significance beyond financial compensation. Discover the benefits and necessary adjustments in light of technological advancements and changing consumer expectations.

- Understanding Diminished Value Claims Today

- The Evolution of Auto Insurance and Its Impact

- Benefits Beyond Financial Compensation

Understanding Diminished Value Claims Today

Diminished value claims have evolved alongside technological advancements and shifting consumer preferences but remain a significant aspect of automotive insurance in 2025. Today, these claims encompass more than just physical damage; they also consider the loss of perceived value due to changes in market trends, technology, and even societal shifts. For instance, a classic car owner might file a diminished value claim if their vehicle’s unique features become less desirable after a new restoration technique gains popularity, effectively reducing its overall worth.

Similarly, while auto painting and bumper repair technologies have advanced, allowing for quicker and more precise repairs, these advancements also create new challenges. Consumers now expect flawless, factory-like finishes, setting higher standards that can lead to diminished value claims if repairs don’t meet these expectations. This underscores the ongoing relevance of diminished value claims in the ever-changing automotive landscape, where both traditional and innovative aspects of vehicle restoration play a pivotal role.

The Evolution of Auto Insurance and Its Impact

The auto insurance landscape has undergone a significant transformation over the past decade, with digital innovation playing a pivotal role in shaping how policies are structured and claims are handled. As we approach 2025, the evolution of auto insurance continues to evolve, driven by changing consumer expectations, advanced technology, and a growing emphasis on efficiency and accuracy. One area that remains crucial despite these changes is diminished value claims—a concept that has adapted to keep pace with modern automotive trends.

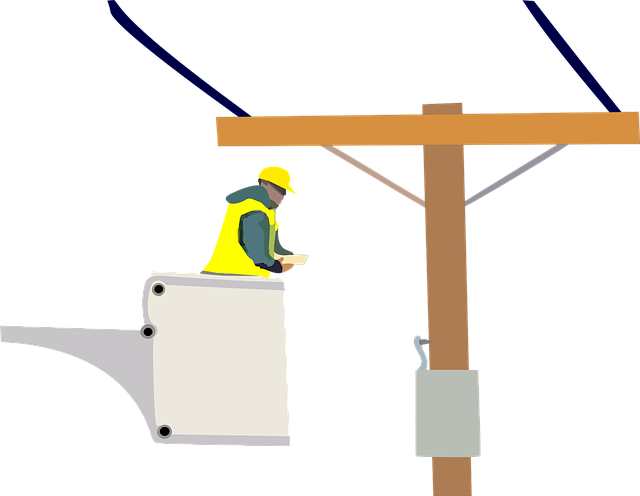

The rise of specialized repair shops offering cutting-edge automotive body work and collision damage repair services has led to more complex and precise assessments of vehicle damage. Digital tools, such as comprehensive insurance claim management software, enable insurers to process claims faster, ensuring a smoother experience for policyholders. These advancements have also contributed to a more transparent and accurate evaluation of diminished value, allowing insurers and claimants alike to better understand the impact of damage on a vehicle’s overall worth.

Benefits Beyond Financial Compensation

While diminished value claims primarily focus on financial compensation for reduced vehicle resale value due to damage, their significance extends far beyond monetary reimbursement. These claims play a pivotal role in ensuring that auto owners receive fair treatment and access to quality repairs following accidents or incidents that impact their vehicles’ condition. Beyond the financial aspect, diminished value claims foster accountability among repair facilities and insurance companies, encouraging them to prioritize meticulous work and utilize top-tier materials, especially for services like auto painting and vehicle dent repair.

The benefits ripple into the broader automotive ecosystem. When insurance providers are incentivized to facilitate accurate diminished value assessments, it drives innovation in restoration practices. This encourages specialized services, such as automotive restoration, to excel, ensuring that vehicles not only return to their pre-incident condition but surpass it. As a result, car owners benefit from higher-quality repairs, leading to increased satisfaction and peace of mind on the road in 2025 and beyond.

Despite evolving insurance landscapes, diminished value claims remain pertinent in 2025. Understanding these claims, their impact on vehicle ownership, and the benefits beyond financial compensation is crucial for both policyholders and insurers. As auto technology advances and ownership models shift, diminished value claims will continue to play a significant role in ensuring drivers are fairly compensated for unexpected vehicle devaluation.