Diminished value claims focus on the reduced worth of vehicles post-damage and repairs. Proper documentation is vital for fair negotiations between claimants and insurance providers. Understanding diminished value ensures realistic expectations in claim settlements by accounting for persistent damage affecting market value. Strategic communication, transparency, and comparable data are key to resolving these claims effectively.

In the intricate landscape of insurance claims, diminished value plays a significant role, especially during negotiations. When an asset, be it a vehicle or property, suffers damage and its market value decreases, it triggers diminished value claims. This article delves into the dynamics of these claims, exploring their impact on negotiation strategies. We’ll unpack effective resolution techniques, offering insights for both claimants and insurers to navigate this intricate process efficiently.

- Understanding Diminished Value Claims

- Impact on Claim Negotiations

- Strategies for Effective Resolution

Understanding Diminished Value Claims

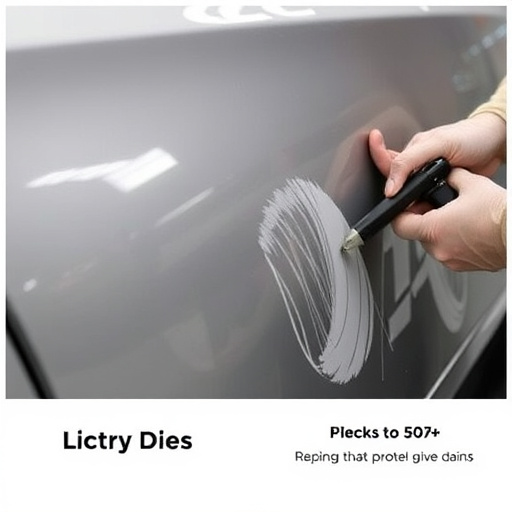

Diminished value claims are a crucial aspect of automotive litigation, focusing on the reduction in a vehicle’s worth due to damage or repairs. This concept is essential for both car owners and insurance companies to understand, as it significantly impacts claim negotiations. When a vehicle sustains damage, whether from an accident or routine wear and tear, it often requires auto maintenance and repairs, particularly to its bodywork and paint. These repairs are typically intended to restore the vehicle’s pre-damage condition. However, in some cases, even with expert restoration, the vehicle may not fully regain its original value. This discrepancy is where diminished value claims come into play.

These claims assert that the cost of repairs, or the reduced market value post-repair, represents a financial loss for the owner. It’s important to note that diminished value isn’t simply about the visible aspects of car bodywork or vehicle paint repair; it considers the overall impact on the vehicle’s resale value and its perceived condition in the eyes of potential buyers. As such, proper assessment and documentation are vital to support these claims during negotiations, ensuring fair compensation for owners and accurate calculations for insurance providers.

Impact on Claim Negotiations

The impact of diminished value claims on negotiations is a significant aspect that cannot be overlooked. When an individual files a claim for auto damage repair, including services like automotive collision center and auto painting, the key consideration goes beyond the visible repairs. Diminished value, or the decrease in an asset’s worth due to damage, plays a crucial role in setting expectations and settlement amounts. This concept recognizes that even after successful auto repair, the vehicle might not fully regain its pre-accident condition or market value.

In claim negotiations, understanding diminished value helps adjust offers accordingly. Auto collision centers and painting services while skilled, can only restore the physical aspects of a vehicle; however, they may fail to recover the psychological and financial loss suffered by the owner. Thus, negotiating with awareness of these limitations ensures a fair outcome for all parties involved, ensuring that claims are settled based on realistic expectations rather than inflated desires.

Strategies for Effective Resolution

To achieve a successful resolution in diminished value claims, both parties—the claimant and the insurance provider—must employ strategic approaches. One key strategy is open communication, ensuring transparency about the extent of damage to the vehicle. This includes detailed documentation of all repairs, including auto body repairs and auto glass repair, as well as visual evidence for supporting the claim.

Additionally, understanding the mechanics of diminished value claims is crucial. For instance, while a vehicle body shop might offer certain services to restore the car to its pre-incident condition, it’s important to recognize that some damages may persist, affecting the overall market value. Negotiators should consider these subtler impacts and leverage relevant data from comparable vehicles to argue for fair compensation.

Diminished value claims significantly influence the dynamics of insurance negotiations, requiring a nuanced approach. By understanding the concept and its impact, claimants and insurers can employ effective strategies for resolution. This involves recognizing the validity of diminished value, negotiating fairly based on evidence, and exploring alternative solutions. Through these methods, both parties can reach agreeable outcomes, ensuring just compensation while streamlining the claim process.