Determining diminished value claims after a collision requires a complex evaluation process. Professionals consider factors like vehicle history, repair needs, part availability, and market demand to assess the decrease in a car's worth post-damage. This collaborative effort involves insurers, auto body shops, and owners, aiming for fair claim settlements through meticulous restoration work.

After a car collision, determining the diminished value of damaged vehicles is crucial for insurance claims and settlement processes. This article delves into the intricate world of diminished value claims, exploring who holds the power to assess these losses. We’ll uncover the key players involved—from insurers to appraisers—and understand how various factors influence the final valuation. By understanding this process, drivers can better navigate post-accident scenarios and ensure fair compensation for their vehicles’ reduced worth.

- Understanding Diminished Value Claims

- Who Plays a Role in Determining Diminished Value?

- Factors Influencing the Assessment of Diminished Value After a Collision

Understanding Diminished Value Claims

After a collision, determining diminished value—the decrease in a vehicle’s worth due to damage—is a complex process. It involves assessing not just the visible car damage repair and cost of vehicle repair, but also factoring in the impact on the vehicle’s functional and aesthetic appeal. This is where diminished value claims come into play. These claims seek to compensate owners for the loss in their vehicle’s market value resulting from accidents or other events.

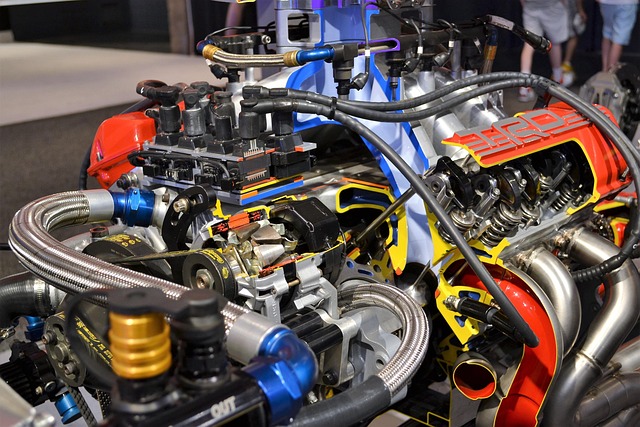

When assessing diminished value, professionals consider the extent of the car body restoration required, the availability and cost of replacement parts, and the time needed for repairs. The goal is to restore the vehicle to its pre-accident condition, ensuring it meets safety standards while maximizing resale value. It’s crucial to remember that every case is unique; the same level of damage may not result in the same diminished value across different vehicles due to variations in make, model, age, and market conditions.

Who Plays a Role in Determining Diminished Value?

When it comes to determining diminished value claims after a collision, several stakeholders play a crucial role. Insurance companies are at the forefront, assessing the extent of damage and calculating the cost of repairs. They often employ specialists or adjusters who have extensive knowledge of collision repair services and auto body painting techniques. These professionals inspect the vehicle, considering both visible and hidden damages that might impact the overall quality and resale value.

Additionally, owners of damaged vehicles can contribute significantly to the process. They provide important insights into their car’s pre-collision condition, maintenance history, and any modifications made. This information is vital for accurately assessing diminished value, as it helps establish a baseline for what the vehicle was worth before the collision. Auto body shops also come into play, offering expert opinions on repair feasibility, estimated timelines, and potential long-term effects of repairs on the vehicle’s structural integrity and appearance, further shaping the final diminished value claim.

Factors Influencing the Assessment of Diminished Value After a Collision

Several factors come into play when determining diminished value after a collision. While it’s a complex process, assessing diminished value claims involves more than just looking at physical damage. The condition and history of the vehicle, as well as the extent of the repair work required, are crucial elements in calculating any reduction in value post-collision.

In addition to these factors, the availability and cost of replacement parts, the reputation of collision repair shops involved, and the overall market demand for the affected vehicle model and year can all influence how much a vehicle’s value diminishes after an accident. Vehicle body repair professionals play a vital role in mitigating this loss by performing meticulous work that restores the vehicle to its pre-collision condition, thereby minimizing diminished value claims. Effective communication between insurers, repairers, and policyholders is essential for ensuring fair assessments and smooth claim settlements during the collision repair process.

In the aftermath of a collision, determining diminished value claims involves a collaborative effort between insurance companies, appraisers, and vehicle owners. Several factors, including the severity of damage, market trends for similar vehicles, and repair costs, play a crucial role in assessing this decrease in value. By carefully evaluating these elements, professionals can accurately calculate the diminished value, ensuring fair compensation for vehicle owners.